Extreme mortgage stress from a series of interest rate rise is felt across the nation. Are you one of the 800,000+ homeowners who took out record-low-fixed-rate home loans during the Covid pandemic? Then you’re going to have to face thousands of dollars more in your monthly repayments, all thanks to the ongoing interest rate hikes.

This is going to cause a serious dent on your personal finances, from mortgage and loan repayments to savings and investments. Therefore, it’s crucial to understand what cash rates are, why interest rates rise happens, and how you can manage your finances during these cash rate hikes.

In this blog, we’ll explore the basics of the Australian RBA interest rates, their effects on the economy, and some practical tips to help you navigate the financial challenges and opportunities during this period. Whether you’re a homeowner, a small business owner, or an investor, this guide aims to help you make the most of your money and stay financially secure in a rising interest rate Australia environment.

What does interest rate rise mean?

An interest rate rise in Australia typically refers to the Reserve Bank of Australia (RBA) increasing the cash rate, which is the benchmark interest rate that commercial banks use to set their lending and deposit rates.

When the RBA raises the cash rate, it makes borrowing more expensive, which can have several effects on the economy and consumers.

Why are interest rates going up?

The main reason for an interest rate rise is to control inflation and maintain economic stability. When inflation is high or threatens to exceed the RBA’s target range of 2-3% (the current Australian inflation rate is sitting at 7.4%), the RBA may raise the cash rate to reduce the demand for goods and services and slow down the economy.

Higher interest rates make borrowing more expensive, which can discourage consumers and businesses from taking out loans and investing in new projects. This can lead to lower consumer spending, lower business investment, and lower economic growth, which can help to reduce inflationary pressures over time.

Another reason why interest rates may go up is to align with global interest rate trends or to respond to changes in the global economic outlook. It’s worth noting that interest rates are also influenced by various domestic and global factors, such as employment, wages, productivity, government policies, trade tensions, and geopolitical risks.

How much will interest rates rise?

It is predicted early on this year by major banks and experts that the cash rate will peak at 4.1%, and will go down slowly after. However, after the US final situation, some including Westpac are predicting the peak rate will be 3.85%.

How to prepare for interest rate hikes? Here are 5 tips

1. Don’t rush into big life decisions

Are you aware of the concept of a “home loan hostage”? This is when you are trapped in your current mortgage terms because you are under circumstances that hinder you from servicing your mortgage in a sustainable way or from refinancing your home loan.

It’s even going to be more difficult if you jump into significant life decisions. A recent study by Mozo revealed that despite these tough times, borrowers are still planning to:

- change jobs (19%)

- have a child (8%)

- take out a new credit card, personal loan, or car loan (18%).

Life happens, but it’s important to take a cautious and informed approach to big life decisions during cash rate hikes. You should consider your financial goals, assess your current and future income and expenses, and seek professional advice.

2. Reassess your household spending

Business confidence are at record lows, all thanks to high interest rates Australia has not seen since the 1990s recession. Consumption is slumping, and it seems that Australian consumers are reining their spending habits in — which is what the RBA actually wants to happen to help combat the rising inflation.

During a cash rate hike, interest rates on loans and credit cards may increase, which can make it more expensive to borrow money and increase your overall debt burden. By reassessing your household spending, you can identify areas where you can reduce your expenses (e.g., travel, eating out, entertainment, luxury goods, etc) and free up some money to cover the higher cost of borrowing.

You may also want to review your existing loans and credit cards to see if you can refinance or consolidate your debts to get a lower interest rate and reduce your monthly repayments. Lastly, consider reviewing your savings and investment strategies to ensure that they are aligned with your financial goals and risk tolerance.

3. When possible, get a savings buffer

Getting a savings buffer during cash rate hikes can provide you with a financial cushion to help you manage unexpected expenses, cover the higher cost of living, and cope with any potential income changes.

When there is space in your monthly budget, do set aside some cash for your safety net. This will help protect you in case of an emergency or unexpected expense and help you to feel more confident and in control of your finances. Those with fixed rate mortgages who had savings buffers are able to better navigate the current stressful situation of rolling off their mortgages than those who didn’t!

4. Refinance your home loan

More and more homeowners are now taking a more proactive approach to managing their finances and home loans. A whopping 2370+ homeowners are now refinancing their home loans every business day!

Refinancing is extremely beneficial because it allows you to:

- take advantage of more competitive rates that are new in the market;

- consolidate you debts; and

- access equity for home improvements, business, or major life events.

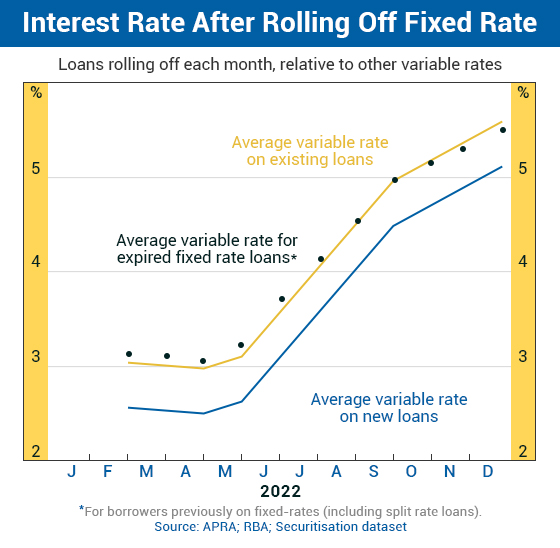

The chart below shows the average variable interest rate on expiry of a fixed rate loan is around 50 basis points higher than the average variable rate on a new home loan. That translates to a significant amount of savings right there.

5. Get help from a mortgage broker

Did you know that more than half of millennial and Gen X borrower (56% and 54% respectively) are eager to work with a broker to help them with mortgages?

Working with a mortgage broker during a period of interest rate rise can be beneficial as they can help you navigate the changing interest rates and find the right mortgage options for you. They can also provide access to a wider range of lenders and loan products, potentially saving you time and money.

Call us for your mortgage and finance solutions

The team at Sunshine Coast Financial solutions is here to assist you with finding mortgage finance solutions that work best for your unique circumstances. Feel free to reach out to us when you have questions or feel ready to take back control of your finances.